Blog

Cryptocurrency Adoption by Corporations and Governments: Benefits, Challenges, and Future Trends in 2025

Introduction

In 2025, the rapid advancement of technology has transformed traditional financial systems, with cryptocurrencies leading the charge. From Bitcoin to Ethereum, digital currencies have gained widespread acceptance among large corporations and governments worldwide. This article explores the reasons behind cryptocurrency adoption, its economic benefits, and the challenges that lie ahead. Whether you’re a business owner or a policymaker, understanding these trends can help you navigate the future of finance. For more information, learn more about CryptoFarmHub.

Why is cryptocurrency adoption growing? Large corporations like Tesla and Microsoft, along with governments like El Salvador, are embracing digital currencies to stay innovative, reduce costs, and enhance financial transparency.

Adoption of Cryptocurrencies by Large Corporations

What Are Cryptocurrencies and Why Do They Matter?

Cryptocurrencies like Bitcoin and Ethereum are digital assets powered by blockchain technology, a decentralized ledger that ensures secure and transparent transactions across a global network. Unlike traditional banking systems, blockchain eliminates intermediaries, making transactions faster and more cost-effective.

For corporations, cryptocurrencies offer:

- Faster Payments: Cross-border transactions that once took days now take minutes.

- Smart Contracts: Automated agreements (e.g., on Ethereum) reduce paperwork and costs.

- Transparency: Every transaction is publicly recorded, reducing fraud risks.

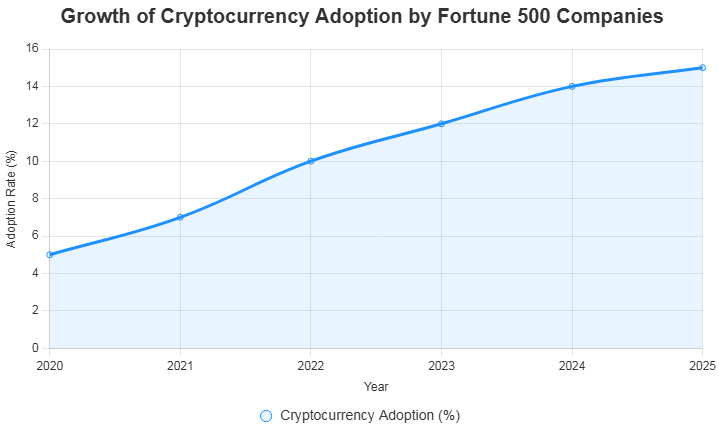

For example, Tesla briefly accepted Bitcoin as a payment method in 2021 and resumed this practice in 2024, signaling its commitment to innovation. As of June 2025, over 15% of Fortune 500 companies have integrated cryptocurrencies into their operations, according to a report by Deloitte.

Why Are Large Corporations Adopting Cryptocurrencies?

Corporations are turning to cryptocurrencies for several compelling reasons:

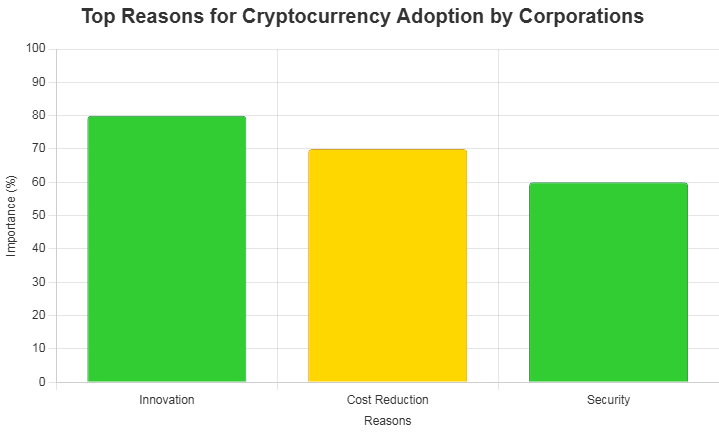

- Innovation and Competitive Advantage

Companies adopting cryptocurrencies position themselves as industry leaders. For instance, Microsoft accepts Bitcoin for payments in its online store, attracting tech-savvy customers and boosting its brand as an innovator. - Lower Operational Costs

Traditional payment methods involve high fees, especially for international transactions. Blockchain transactions, however, can reduce costs by up to 30%, according to a PwC study in 2025. - Enhanced Financial Security

Blockchain’s cryptographic security reduces the risk of fraud and cyberattacks. In 2024, JPMorgan Chase reported a 40% decrease in fraud incidents after integrating blockchain for internal transactions.

Adoption of Cryptocurrencies by Governments

How Are Governments Adopting Cryptocurrencies in 2025?

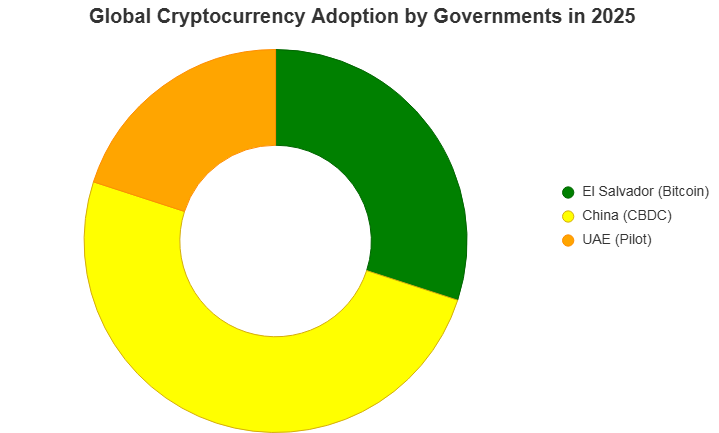

Governments worldwide are exploring cryptocurrencies to modernize their economies. El Salvador made history in 2021 by adopting Bitcoin as legal tender, and by 2025, this move has attracted over $2 billion in foreign investment, according to the World Bank. This adoption has also reduced remittance costs for Salvadorans abroad by 20%.

Conversely, China has banned private cryptocurrencies like Bitcoin and focused on its Central Bank Digital Currency (CBDC), the digital yuan. As of June 2025, over 70% of transactions in China’s retail sector use the digital yuan, showcasing the government’s control over digital finance.

Other countries like the UAE and Singapore are piloting their own CBDCs, aiming to balance innovation with regulation.

Opportunities and Challenges of Cryptocurrency Adoption for Governments

Governments adopting cryptocurrencies face both opportunities and hurdles:

Opportunities

- Financial Transparency: Blockchain ensures all transactions are traceable, reducing corruption. For example, Ukraine used blockchain in 2024 to track $500 million in aid funds transparently.

- Economic Efficiency: Digital currencies streamline tax collection and public spending. The UAE reported a 15% increase in tax compliance after piloting its CBDC in 2025.

Challenges

- Regulatory Frameworks: Governments need new laws to manage cryptocurrencies. The EU’s MiCA regulation, fully implemented in 2025, aims to standardize crypto rules across member states.

- Cybersecurity Risks: Despite blockchain’s security, hacks on crypto exchanges remain a concern. In 2024, a South Korean exchange lost $100 million to a cyberattack, highlighting the need for robust security measures.

Economic Benefits of Cryptocurrency Adoption

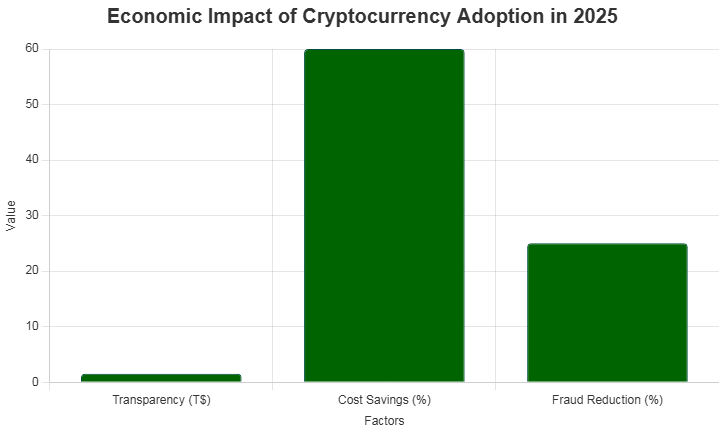

The global economy stands to gain significantly from cryptocurrency adoption:

- Increased Transparency: Blockchain’s public ledger makes all transactions traceable, reducing black-market activities. A 2025 IMF report estimates that blockchain could reduce global financial crime by $1.5 trillion annually.

- Cost Reduction: Transaction fees for cross-border payments drop significantly. For example, Ripple’s XRP reduced remittance costs by 60% for banks in 2024.

- Lower Fraud Risks: Cryptographic security makes transactions tamper-proof. In 2025, Chainalysis reported a 25% decrease in crypto-related fraud compared to 2023.

Conclusion

The adoption of cryptocurrencies by corporations and governments in 2025 is paving the way for a more transparent and efficient global economy. However, success depends on addressing challenges like regulatory gaps and cybersecurity risks. By developing robust policies and infrastructure, stakeholders can unlock the full potential of digital currencies. Ready to dive into the crypto world? Explore our products page to start mining Bitcoin with CryptoFarmHub today! For more educational content, check out our educational articles.